Taxes

Where to set up taxes

Taxes are set up in 2 places on the platform - the Taxes page (admin/payments/taxes) and Exhibitor Manual (Equipment and Lead capture). Taxes that are set up in the exhibitor manual take precedence over those that are set up on the Taxes page.

Places where taxes are displayed

Payment page - counted while making a payment.

Taxes page settings

Tax name - Set up a custom name that will be seen in these different places in the platform:

Front-end:

Exhibitor Basket - There is a tax field in the basket section (equipment, lead capture) and at the bottom of the basket.

Payment pages for participants and exhibitors

Registration Summary - Tickets tab (tax amount on the bottom after the ticket is selected)

Sessions tab - session cards

Admin panel:

admin/payments/transactions - VAT amount column.

admin/payments/invoices - VAT amount column.

admin/events/byBooking - VAT amount column.

admin/events/byBooking - Tax column in the report.

Payments report in admin/data - VAT amount column.

In the invoice file that admin can download or the one that is sent to the payer after the transaction is done - VAT Rate and VAT Amount. Changes should be done for newly generated invoices and not for the old ones.

Billing Company Country - Organizer can select the country of the company receiving payment, and the system will automatically determine the default tax for that country. This tax will be applied to users who fall under the norms of that country's VAT Law and will not be applied to users who do not fall under the country's VAT Law. The following rules are currently applying only to EU countries.

Default Tax % - the tax percentage value of the country indicated previously. It can be disabled with the toggle below "Disable VAT rules" which will allow you to indicate custom tax.

Billing Company VAT - unique code issued to companies that are registered to pay VAT

Learn more about the VAT rules and Disable VAT rules setting in this article.

Custom Taxes

It’s possible to set up a custom tax on this page for Tickets and Sessions (Offline Events). So while for the rest of the items we will have default tax applied, for the above-mentioned items it’s possible to have a separate custom one.

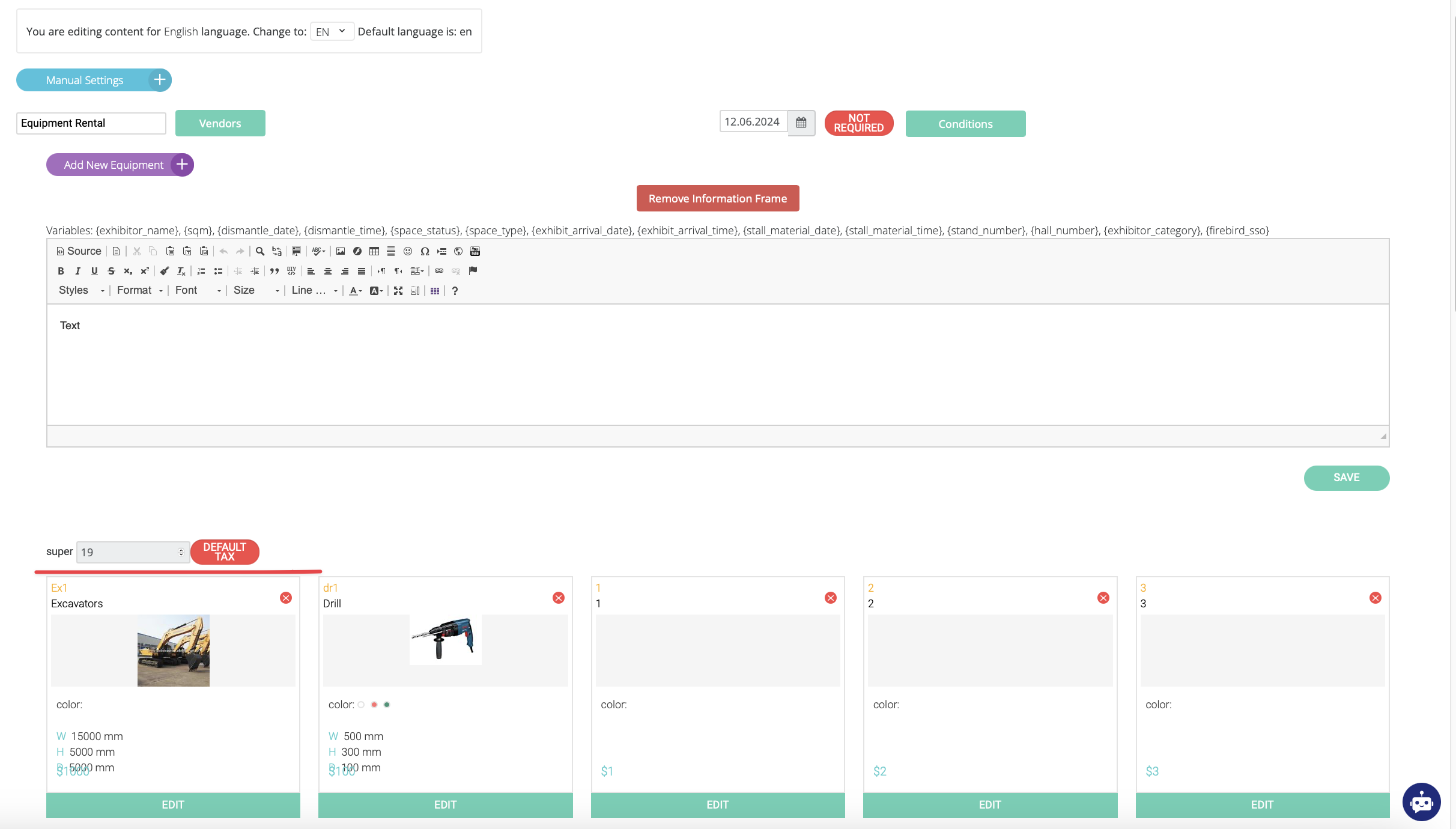

There is a setting for setting up custom taxes for the Equipment and Leads section of the exhibitor manual.